🔹 Introduction

GST, launched on 1st July 2017, unified multiple central and state taxes, creating a common national market.

After 8 years, the 56th GST Council Meeting (Sept 2025) approved Next-Gen GST reforms to simplify rates, reduce burdens, and drive economic growth.

PM Modi announced these reforms as a “Diwali gift” to benefit the common man, MSMEs, farmers, women, youth, and middle-class families.

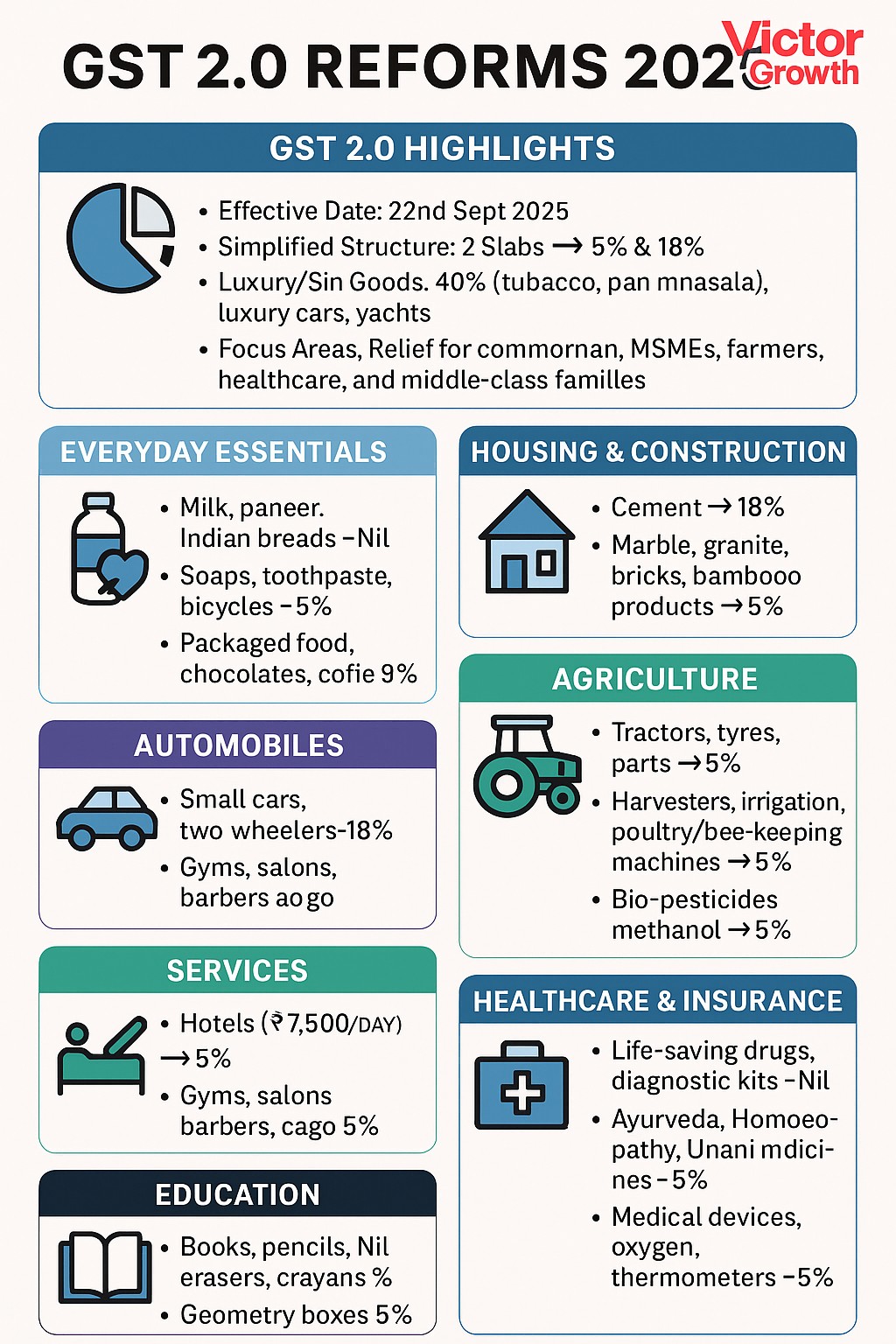

🔹 Key Features of Reforms

Simplified Structure: Only two slabs – 5% and 18% (removal of 12% & 28%).

Essentials: Daily-use goods like soaps, toothpaste, breads → 5% or Nil.

Healthcare: Life-saving drugs → Nil or 5%; medicines & medical devices → 5%.

Vehicles & Durables: Small cars, two-wheelers, TVs, ACs, cement → 18%.

Farming: Tractors, irrigation equipment, machinery → 5%.

Luxury/Sin Goods: Tobacco, pan masala, aerated drinks, luxury cars, yachts → 40%.

Effective from 22nd September 2025.

🔹 7 Pillars of GST 2.0

Simplified 2-tier tax structure.

Relief for households & common man.

Empowering MSMEs with lower compliance burden.

Supporting farmers & agriculture.

Boosting manufacturing & exports.

Strengthening state revenues.

Driving consumption-led growth.

🔹 Sector-Wise Benefits

🏠 Household & Food

Milk, paneer, Indian breads → Nil.

Soaps, toothpaste, bicycles → 5%.

Packaged foods (namkeen, sauces, chocolates, coffee) → 5%.

TVs, ACs, dishwashers → 18% (from 28%).

🏗️ Housing & Construction

Cement → 18% (from 28%).

Marble, granite, bricks → 5%.

Bamboo/wood packaging → 5%.

🚗 Automobiles

Small cars, two-wheelers → 18%.

Buses, trucks, auto parts → 18%.

🌾 Agriculture

Tractors, tyres, parts → 5%.

Harvesters, irrigation equipment, poultry/bee-keeping machines → 5%.

Bio-pesticides & menthol → 5%.

🏨 Service Sector

Hotels (< ₹7,500/day) → 5%.

Gyms, salons, barbers, yoga → 5%.

🎭 Toys, Sports & Handicrafts

Man-made fibre & yarn → 5%.

Handicraft idols, paintings, toys → 5%.

🎓 Education

Books, pencils, erasers, crayons → Nil.

Geometry boxes, trays → 5%.

🏥 Medical & Insurance

Life-saving drugs & kits → Nil.

Ayurveda, Homoeopathy, Unani medicines → 5%.

Spectacles, medical devices, oxygen, thermometers → 5%.

Life & Health Insurance premiums → GST Exempt.

🔹 Wider Benefits for All

Cheaper goods → higher savings → more consumption.

MSMEs more competitive due to reduced input costs.

Simpler compliance with two rates → fewer disputes, quicker refunds.

Larger tax base & better revenue through voluntary compliance.

Boost to domestic manufacturing & exports by correcting inverted duty structures.

Stronger social protection with exemptions on insurance & essential medicines.

🔹 Performance of GST (2017–2025)

Taxpayer base expanded from 66.5 lakh (2017) → 1.51 crore (2025).

GST collections doubled to ₹22.08 lakh crore in FY 2024–25, CAGR 18%.

Avg. monthly collections rose from ₹82,000 crore (2017–18) → ₹2.04 lakh crore (2025).

🔹 Conclusion

GST 2.0 introduces fairer, simpler, and growth-oriented taxation. By lowering costs for essentials, boosting businesses, and exempting critical healthcare/insurance, the reforms ensure ease of living + ease of doing business.

Effective 22nd Sept 2025, they represent a milestone in India’s journey toward inclusive prosperity and economic transformation.