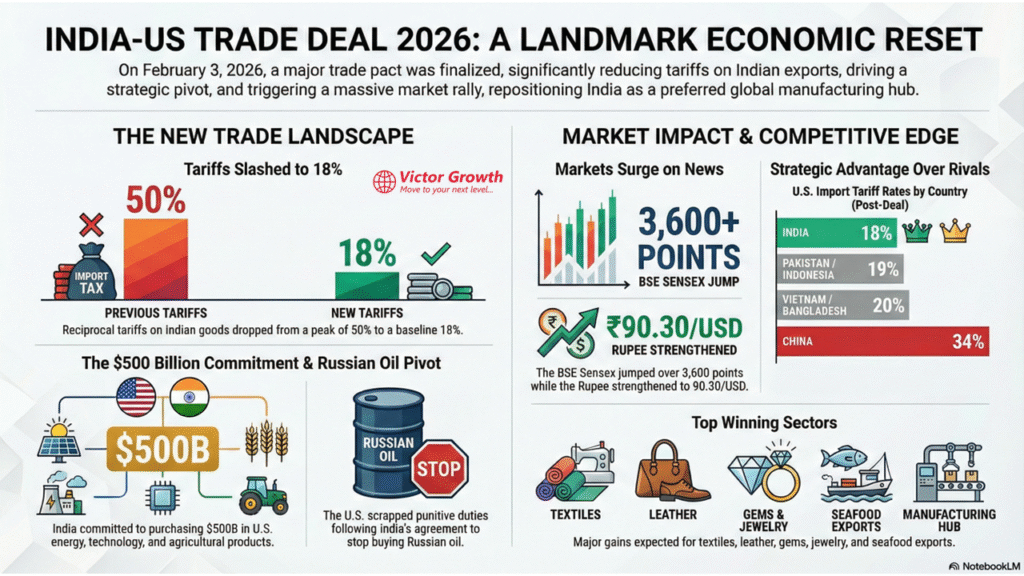

1. Contextualizing the 18 Per Cent Tariff Paradigm

The February 2026 India-U.S. trade agreement serves as a paradigm-shifting de-escalation of what had recently become a prohibitive trade regime. Prior to this accord, Indian exports were essentially throttled by a cumulative 50% tariff wall—a combination of a 25% reciprocal tariff and a 25% punitive levy tied to New Delhi’s energy arbitrage with Moscow. The reduction of the headline reciprocal tariff to 18%, and the effective dismantling of the punitive surcharge, signals a decisive pivot toward a stabilized trade environment.

The core objective of this analysis is to evaluate India’s newfound price parity and its capacity to anchor the “Make in India” initiative within a more resilient global supply chain. This move is less about a return to the status quo and more about a strategic realignment. By establishing an 18% floor, the agreement seeks to institutionalize trade certainty, transitioning India from a high-friction market participant to a preferred manufacturing hub. As we examine the comparative data, it becomes evident that India has successfully negotiated a regional “first-mover” advantage that fundamentally alters the export hierarchy in South and Southeast Asia.

2. Comparative Advantage: Evaluating the New Regional Export Hierarchy

In the calculus of global manufacturing hub selection, relative tariff rates are the primary determinant of capital allocation. For multinational corporations, duty structures are not merely line-item costs; they are the pivots upon which multi-billion-dollar procurement shifts occur. The 18% rate is a strategic differentiator intended to capture redirected order flows as businesses pursue “de-risking” strategies away from more volatile trade partners.

Comparative U.S. Import Tariff Landscape (Post-February 2026)

Country/Entity | Current U.S. Tariff Rate | Strategic Competitive Standing |

India | 18% | Regional Leader: Holds the lowest reciprocal rate among major peers. |

Indonesia | 19% | Competitive, but trailing India by 100 basis points. |

Pakistan | 19% | Competitive, yet lacks the strategic depth of the India-US pact. |

Bangladesh | 20% | Structural disadvantage in thin-margin labor-intensive sectors. |

Vietnam | 20% | Primary manufacturing rival now facing a 2% price handicap. |

China | 34% | Prohibitive; India maintains a 16% structural advantage. |

This 18% rate provides India with a critical 2% edge over Vietnam and Bangladesh. While 200 basis points may appear marginal to the lay observer, in the high-volume, low-margin world of global apparel and manufacturing, this gap often represents the entire net profit margin of a contract. This “tariff-sensitive elasticity” is expected to trigger a significant migration of order volumes. By undercutting the 20% threshold faced by its most direct rivals, India has effectively established a cost-competitive moat that restores buyer confidence and justifies long-term capital expenditure in Indian production facilities.

3. Sector-Specific Momentum: Assessing Impact on Labor-Intensive Verticals

Labor-intensive sectors are the most responsive to marginal duty fluctuations, serving as the primary engines for India’s “Viksit Bharat” ambitions. These verticals are the frontline beneficiaries of the tariff de-escalation, as they are most sensitive to the friction costs of trade uncertainty.

- Textiles and Apparel: The Apparel Export Promotion Council (AEPC) views the 18% rate as a restoration of price parity. Given that the U.S. is India’s largest export destination, this reduction allows Indian garments to reclaim market share from Southeast Asian competitors who are now on the wrong side of the duty curve.

- Gems and Jewelry: Moody’s has designated this reduction as “credit positive.” As a top-tier export category, the move improves the liquidity and margin profiles of Indian exporters who had been squeezed by the previous 50% barrier.

- Leather and Footwear: Explicitly highlighted in the source context as a key winner, this sector is poised for a multi-year structural tailwind, benefiting from a surge in stock prices (up to 20%) immediately following the announcement.

- Seafood and Marine Products: Following a 15% volume decline in frozen shrimp exports during the previous fiscal period, the Seafood Exporters Association of India (SEAI) anticipates a sharp rebound as the “level playing field” is restored.

- Engineering and Auto Components: These sectors are positioned to benefit from the broader structural shift away from Chinese supply chains, leveraging the 16% tariff delta against Beijing to secure long-term contracts.

The “So What?” of Policy Certainty: The strategic value of this deal extends beyond the headline percentage. It fundamentally solves the “uncertainty” trap that had plagued Indian exports. Previously, the threat of shifting duties led U.S. buyers to store Indian goods in bonded warehouses rather than clearing them, incurring massive carrying costs and logistical friction. The 18% floor provides the “duty certainty” required for buyers to bypass these de-risking mechanisms and commit to direct-to-factory procurement.

4. Macroeconomic Resurgence and Investor Sentiment

Trade policy stability is the bedrock of capital market resilience. The 18% paradigm triggered an immediate “relief rally,” effectively pricing in the removal of a 15-month geopolitical overhang that had suppressed Indian asset valuations.

- Equities: The BSE Sensex recorded a historic intraday surge of over 4,200 points (5.14%), while the NSE Nifty jumped nearly 5%. This reflects a massive reversal of the negative sentiment that had dominated since the escalation of trade tensions in late 2024.

- Currency: The Rupee appreciated sharply to 90.27/90.30 against the U.S. Dollar. While this signals strength, the RBI is expected to manage these flows to prevent excessive appreciation from eroding export competitiveness.

- Investor Flows: With the U.S. accounting for 41% of FPI assets in India, the deal is a catalyst for reversing the $34 billion outflow seen since October 2024. Analysts now see India’s valuation premium returning toward long-term averages.

- Growth Projections: On the strength of improved market access, the Chief Economic Adviser (CEA) has revised the FY27 GDP growth outlook upward to 7.4%.

5. Geopolitical Trade-offs: The Art of the Strategic Bargain

The reduction to 18% was the product of a classic “Art of the Squeeze” negotiation, where the U.S. utilized the 25% penal levy—linked to Russian oil—as a lever to force a total energy and strategic realignment.

- The Russian Oil Pivot: The removal of the 25% punitive surcharge was contingent upon India’s reported commitment to cease Russian oil purchases. While the Kremlin claims no official notification has been received, the market is treating the U.S. announcement of a cessation as the price paid for tariff relief.

- The $500 Billion Signaling Device: India’s pledge to “Buy American” across energy, technology, and coal is an eye-catching figure. However, a cynical strategist must view this more as a strategic signaling device than a guaranteed procurement schedule. Historically, such figures in Trump-era deals (such as with South Korea or Japan) serve to pander to the administration’s obsession with big numbers, though their realization over time remains a point of debate.

- Agricultural Discrepancy: While U.S. Agriculture Secretary Brooke Rollins hailed “unprecedented access” to India’s market, citing a $1.3 billion trade deficit, actual source data reveals a much wider gap of $3.8 billion in 2024. This discrepancy suggests the U.S. may be underplaying its current advantage to justify further opening of India’s historically protected dairy and grain sectors—a potential flashpoint for domestic Indian policy.

6. Long-Term Implications for Global Supply Chain Integration

For “Make in India” to mature into a global manufacturing hub, it must transition from commodity exports to “trusted technology partnerships.” This deal is the technological backbone of that transition.

- The TRUST Framework: The agreement unblocks progress in the TRUST framework, facilitating deep-tier collaboration in AI, semiconductors, space, and defense. This moves the bilateral relationship beyond mere trade into a structural technological alliance.

- Supply Chain Resiliency: The 18% tariff supports the “China Plus One” strategy by providing the economic justification for U.S. firms to relocate manufacturing to India without sacrificing margins.

- MSME Integration: Trade predictability allows small and medium enterprises—the backbone of Indian employment—to finally invest in capacity expansion with the confidence that their U.S. market access will not be revoked overnight.

Strategic Risk (The South Korea Precedent): A clear and present danger remains. Strategists must recall the South Korea precedent, where the U.S. administration raised tariffs later after accusing Seoul of reneging on investment commitments. India’s 18% moat is conditional; should the $500 billion procurement fail to materialize or the Russian oil cessation be verified as incomplete, the tariff lever could be pulled again.

7. Conclusion: The Path Toward 2047

The February 2026 agreement is a watershed moment for Indian credibility, demonstrating a sophisticated ability to navigate “geopolitical arbitrage”—balancing energy security with the necessity of a U.S. strategic alliance.

While the 18% tariff rate establishes a formidable competitive moat against regional rivals like Vietnam and China, it remains a fragile geopolitical equilibrium. Its sustainability is entirely dependent on India’s capacity to fulfill its massive procurement pledges and the continued verification of its energy pivot. If maintained, this deal provides the structural tailwinds required to accelerate India toward its “Viksit Bharat 2047” goals; if breached, the return of high-friction tariffs remains only one executive order away.